By implication, the debt service-to-revenue ratio stood at 112%, which is significantly higher than the 40% claimed by the Tinubu-led administration in its press statement.

President Bola Tinubu’s claim that Nigeria’s debt service-to-revenue ratio dropped from 100% in 2022 to 40% in 2024 conflicts with Central Bank of Nigeria (CBN) data.

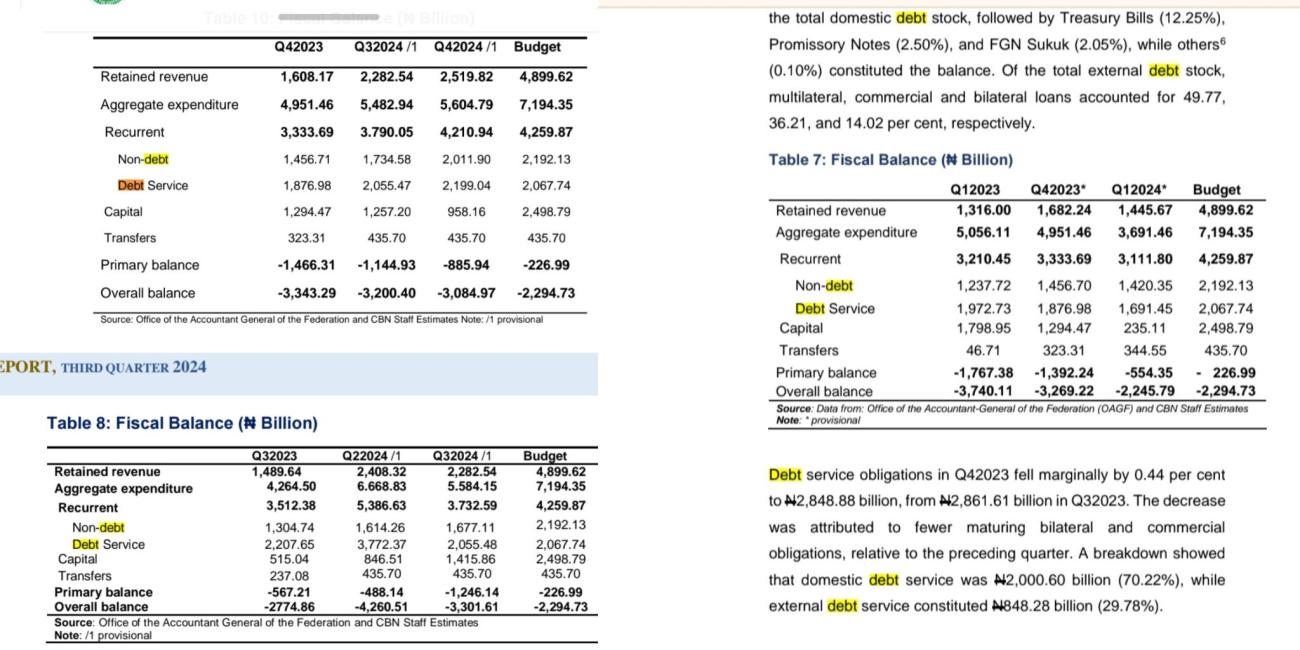

A SaharaReporters review of CBN quarterly reports reveals the federal government’s retained revenue in Q4 2024 was N2.519 trillion, while debt servicing cost N2.199 trillion—an 87% ratio, far higher than Tinubu’s 40% assertion. Similar gaps were found in Q1-Q3 2024, with Q2 hitting a staggering 157% ratio (N3.772 trillion debt service vs. N2.408 trillion revenue).

“Our debt service-to-revenue ratio dropped from nearly 100% in 2022 to under 40% by 2024,”* Tinubu stated. However, CBN figures show ratios consistently exceeding 80% in 2024, peaking when debt service eclipsed revenue by N1.364 trillion in Q2.

READ THE FULL STORY IN SAHARA REPORTERS