Many Nigerians abroad cited routine support for family as their main motivation.

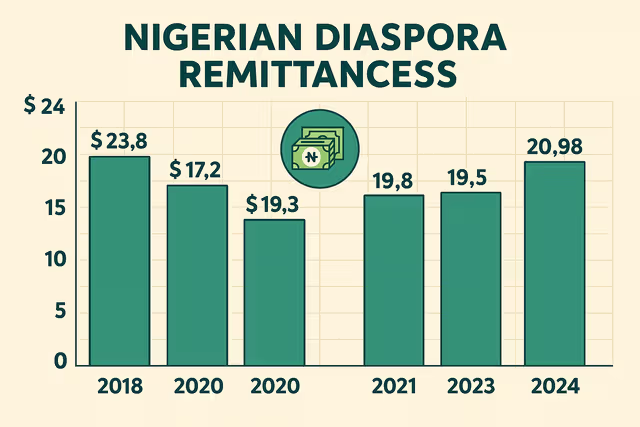

Nigeria received a five-year high of $20.93 billion in diaspora remittances in 2024, driven by emotional ties, family commitments, and fintech innovation, despite a 40.9% depreciation of the naira.

The Central Bank of Nigeria attributed the surge to economic reforms including forex unification and the launch of EFEMS. Monthly inflows rose from $250 million in January to $600 million in September.

CBN Governor Yemi Cardoso said, “Our policy reforms are restoring trust in the remittance pipeline.” But analysts argue that deep-rooted emotional obligations outweigh economic logic.

“What we have seen generally is that the diaspora in the UK does not want to hold their value in Naira, so they do just-in-time transfers,” said Moniepoint GB CEO Ravi Jakhodia.

Many Nigerians abroad cited routine support for family as their main motivation.

“It’s not like my mom needs it… but that’s my mom,” said Mira, a UK-based healthcare worker.

Others also support small businesses. “There’s this fish business my mother began… I send money to help grow it,” she added.

Fintech platforms like Moniepoint’s MonieWorld now offer diaspora-specific services. In 2024, Nigerian fintech startups raised $140 million in H1 alone.

In addition to necessity, remittances also reflect a sense of responsibility and solidarity.

“Yes, I send money back home to family, friends, and my cousin,” said Gabriel, a UK-based data analyst. “It’s not like I have to… I just do.”

READ MORE AT BUSINESS INSIDER.