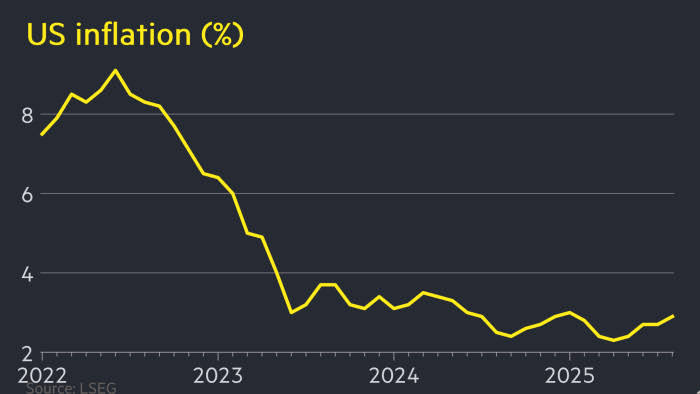

Inflation rose to 2.9% in August as gas, food, and travel costs climbed, complicating the Federal Reserve’s plan to cut rates amid weakening jobs data.

Inflation accelerated in August as gas, grocery and airfare prices surged, even as layoffs increased, leaving the Federal Reserve in a bind ahead of its policy meeting next week.

Consumer prices rose 2.9% from a year earlier, up from 2.7% in July, the Labor Department reported Tuesday. Core inflation, excluding food and energy, climbed 3.1%, above the Fed’s 2% target. The data arrives just before the Fed’s two-day meeting, where policymakers are expected to cut rates to about 4.1% from 4.3%.

President Donald Trump has pressed for deeper cuts, but rising prices complicate the Fed’s path. “Consumer inflation came in mildly hotter than forecast, but not nearly high enough to prevent the Fed from starting to cut rates next week,” said Kathy Bostjancic, chief economist at Nationwide.

Meanwhile, unemployment rose to 4.3% and weekly jobless claims surged by 27,000 to 263,000. The highest in nearly four years signaling slowing hiring and rising layoffs.

On a monthly basis, inflation rose 0.4%, driven by gas prices up 1.9%, grocery costs up 0.6%, and airfares up 5.9%. With tariffs also pushing up import costs, businesses warn of further price hikes.