Three of Nigeria’s biggest banks—Access Holdings Plc, Zenith Bank Plc, and First Bank Holdings—may suspend dividend payments until 2028

Three of Nigeria’s biggest banks—Access Holdings Plc, Zenith Bank Plc, and First Bank Holdings—may suspend dividend payments until 2028, following new Central Bank of Nigeria (CBN) regulations. According to a June 16 Renaissance Capital report, the CBN’s June 13 directive mandates banks to halt dividends, defer executive bonuses, and pause offshore expansion until they adequately provision for legacy forbearance exposures and address single obligor limit breaches.

“Our base case is that the banking arms of AccessCorp, ZenithBank, and FirstHoldco will not resume dividend payments before 2028,” the report stated. “Most of their near-term cash flows will be directed towards absorbing provisioning costs and recapitalisation.”

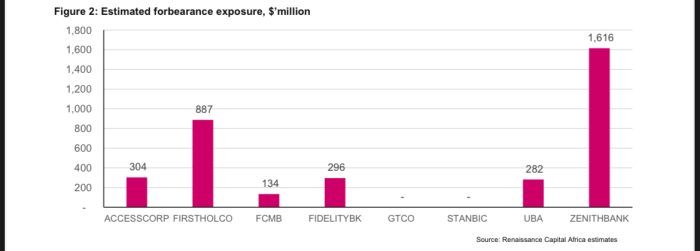

Despite strong 2024 accounting profits, Access and Zenith reported negative cash profits, while FirstHoldco’s cash position turned negative in Q1 2025. In contrast, GTCO is expected to continue dividends, and UBA may resume payouts by 2026. Renaissance estimates total forbearance exposure among six banks at $3.5 billion.